Bookkeeping

What Are Chart of Accounts? How It Works, Setting up & Pros

FreshBooks offers a wide variety of accounting tools, like accounting software, that make it easier to stay organized. The COA is typically set up to display information in the order that it appears in financial statements. That means that balance sheet accounts are listed first and are followed by accounts in the income statement. Here is a way to think about a COA as it relates to your own finances. Say you have a checking account, a savings account, and a certificate of deposit (CD) at the same bank.

Unique identification

To learn more about the chart of accounts, see our Chart of Accounts Outline. This granularity aids in precise tracking and management of finances. Now that we’ve covered what a COA is, next, we’ll explore how this system works to keep a business’s financial details in order. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals.

To Ensure One Vote Per Person, Please Include the Following Info

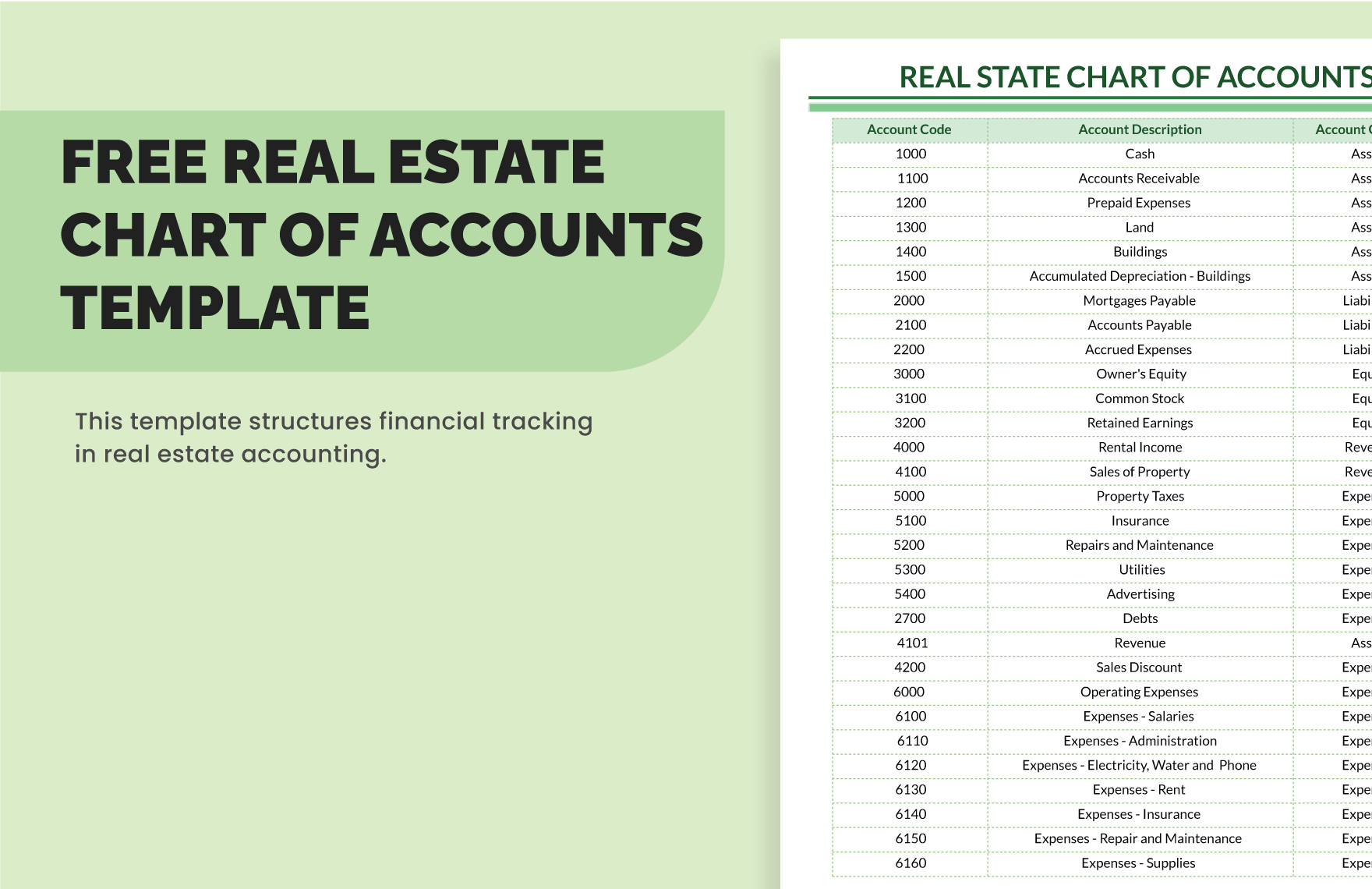

Each account in this example can be further detailed or expanded based on the specific needs of the business, such as adding separate accounts for different types of services or inventory. FreshBooks will help you stay organized with a user-friendly interface that keeps things simple. A chart of accounts is a document that numbers and lists all the financial transactions that a company conducts in an accounting period.

Plural and Possessive Names: A Guide

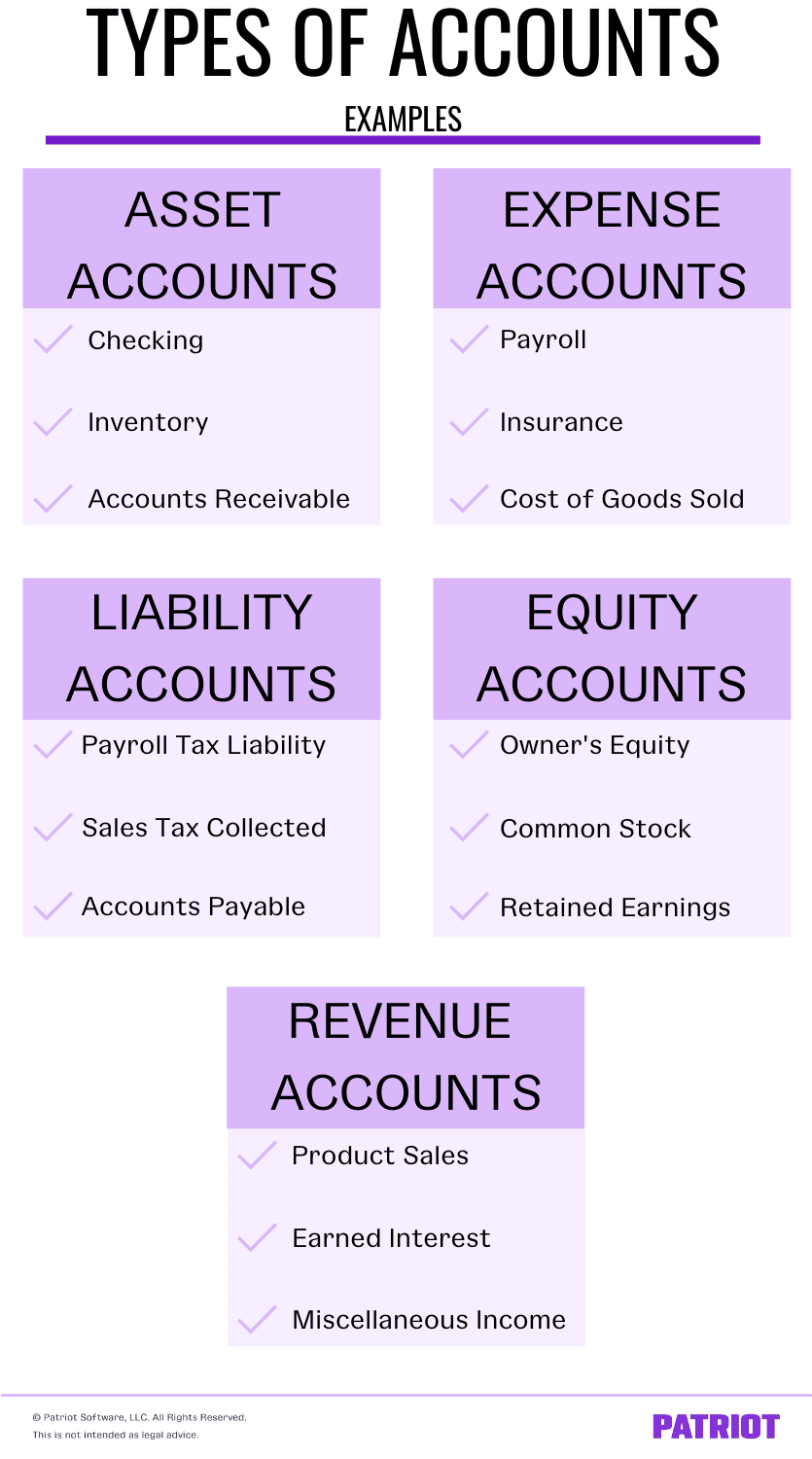

An expense account balance, for example, shows how much money has been spent to operate your business, whereas a liabilities account balance shows how much money your business still owes. In accounting, each transaction you record is categorized according to its account and subaccount to help keep your books organized. These accounts and subaccounts are located in the COA, along with their balances. We believe everyone should be able to make financial decisions with confidence. The complete Swedish BAS standard chart of about 1250 accounts is also available in English and German texts in a printed publication from the non-profit branch BAS organisation. The French generally accepted accounting principles chart of accounts layout is used in France, Belgium, Spain and many francophone countries.

Types of Chart of Accounts and Chart of Accounts Best Practices

As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate. A chart of accounts is usually created for an organization by an accountant and available for use by the bookkeeper. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Yes, each business should have its own Chart of Accounts that outlines the specific account categories and numbers relevant to their operations. Liabilities are all the debts that your company owes to someone else.

Easy-To-Use Platform

Delivered as SaaS, our solutions seamlessly integrate bi-directionally with multiple systems including ERPs, HR, CRM, Payroll, and banks. Most modern accounting systems allow you to customize and expand your COA directly within the software, streamlining data entry and reporting. Setting up a chart of accounts (COA) is a critical step for any business to effectively manage its financial records. Here’s a step-by-step guide to help you establish a COA that suits your business needs and enhances your financial reporting capabilities. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Also, it’s important to periodically look through the chart and consolidate duplicate accounts. Although most accounting software packages like Quickbooks come with a standard or default list of accounts, bookkeepers can set up and customize their account structure to fit their business and industry. An easy way to explain this is to translate it into personal finance terms. When you log into your bank, typically you’ll get a dashboard that lists the different accounts you have—checking, savings, a credit card—and the balances in each. Every time you record a business transaction—a new bank loan, an invoice from one of your clients, a laptop for the office—you have to record it in the right account.

This will allow you to quickly determine your financial health so that you can make intelligent decisions moving forward. The Chart of Accounts is an indispensable tool in the realm of accounting, vital for accurate and efficient financial management. Understanding its structure, types, and best practices is key to maintaining an organized financial record-keeping system. Thanks to accounting software, chances are you won’t have to create a chart of accounts from scratch. Accounting software products generally set you up with a basic chart of accounts that you can work with your accountant or bookkeeper to amend, according to your industry and your business’s complexity. The table below reflects how a COA typically orders these main account types.

- Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement.

- Both short-term (typically less than a year) and longer-term liability accounts exist.

- The balance sheet accounts (asset, liability, and equity) come first, followed by the income statement accounts (revenue and expense accounts).

- You can customize your COA so that the structure reflects the specific needs of your business.

Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business. Make sure that your line items have titles that make sense to you and your accountant, so use straightforward titles like ‘bank fees’, or ‘bottling equipment’. Our partners cannot pay us to guarantee favorable reviews of their products or services. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Revenue is the amount of money your business brings in by selling its products or services to clients.

Each account within the COA is typically assigned a unique identifier, usually a numerical code (see examples below), to facilitate data entry and reporting. A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger. It provides you with a birds eye microsoft 365 developer podcast view of every area of your business that spends or makes money. The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health.

In contrast, the general ledger is where all financial transactions of a company are recorded and summarized using the accounts from the COA. Accurate data recording lies at the heart of preparing a COA, and Journal Entry Management simplifies the creation and management of journal entries. From automating journal entry preparation to automated posting, it significantly reduces the potential for human error and ensures consistent, accurate record-keeping. This is particularly beneficial for managing a COA efficiently, as it allows for real-time updates and minimizes discrepancies in financial data. Modern accounting systems offer tools for automating data entry, generating reports, and even suggesting account categorizations based on transaction types. The structure of a COA not only facilitates accurate financial recording and reporting but also ensures that all financial transactions are accounted for systematically.